Datatel embarked on a study to observe, document and quantify customer preferences when interacting with a business to initiate payments by phone., specifically, when provided with the choice to speak to a live staff or the choice to interact with a fully automated option for making payments. The study tracked activity in the first month the automated option was offered, as well as the first three (3) months and finally twelve months (12).

Over the course of the first three (3) months, customer preferences when it came to their bill

paying option appeared to undergo a significant transformation that has continued up to the present day.

Briefly explained, IVR Payments – also known as Automated Pay By Phone – are payment applications that enable customers to interact with an automated system over the telephone to pay bills and/or store credit cards that can be used for future payments by interacting with an automated Interactive Voice Response (IVR) system.

With IVR Payments, the process by which a business can collect their customer’s credit card information by phone is fully automated and secure, which meets PCI compliance guidelines. Staff and live agents need never have access to customers’ payment information.

The two (2) most commonly used IVR Payment applications are – Customer Self-Service and Agent Assisted.

With the Customer Self-Service approach, customers can pay their bills 24/7 by phone without any live agent or staff intervention.

With the more high-touch Agent Assisted approach, customers have the option to interact with agents up until the point where they are required to enter their credit card information. At this point the agent connects them to the automated IVR payment application for the card entry or/and card registration.

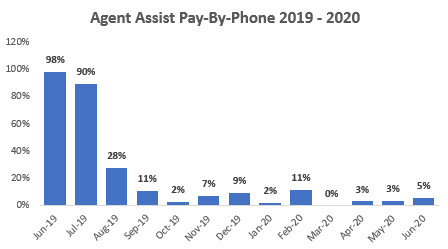

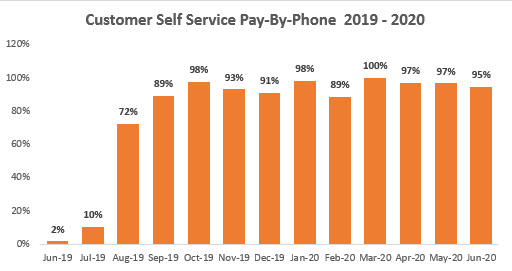

For this study, Datatel examined companies that opted to offer their customers a combination of both, i.e. they were given the option to (a) speak to an agent first before making a payment and (b) making a customer self-service payment with no agent involvement. In the first month, when the companies began offering the Automated Pay-By-Phone option to its customers, the majority of customers chose to speak to an agent by an overwhelming margin. In the first month that the Pay By Phone was available to customers, 98% of the payment calls were being handled by agents who then transferred the call when it came time for the customer to enter their credit card information.

By the second month, while there was a noticeable increase in the number of customer self-service payment calls, the agent- assisted calls were still nearly 90% of the total. However, by the 3rd full month of their Automated Pay-By-Phone option being available to customers there was a much sharper uptick in the number of Customer Self-Service payment calls being placed, to the extent that they now constituted a significant majority of the payment calls, by a margin of 72% (Customer Self-Service) to 28% (Agent Assisted/Transferred)

By the 4th month, of the Automated Pay By Phone availability to customers, 98% of the payment calls were through the customer self-service payment calls option, and that figure has remained in the 90s ever since for the duration of the study, with the exception of February of 2020 when it was 89% (see charts below)

The reasons for this dramatic upsurge of Customer Self-Service transaction are still being tracked and analyzed, but there was a definite major upward swing in the use of the customer self-service option reflected in the third month numbers that has held consistently thereafter. Assuming that this continues to be the case, what has this meant for the business?

What are the implications for businesses?

For starters, the numbers would seem to suggest that at some point customers became more widely aware that there was a fully automated customer self-service option available for paying their bills 24/7 and opted for the speed and convenience of this option, and have continued to do so on a consistent basis. This presented management with the opportunity to re-calibrate their approach to staffing. If their staff that are answering the phone have additional duties other than handling payment calls, then the wide adoption of the customer self-service payment option means again that either (a) fewer of them will be required as the business grows or (b) they can now spend more time on those duties that had to be de-prioritized during peak times. Either way, the adoption here of an automated pay by phone strategy to handle bill payments has enabled the business to realize a significant cost benefit, either in the form of lower overall labor costs or a more efficient utilization of existing personnel to shore up and/or grow and improve other areas of the business, as well as providing their customers with a more convenient and secure method of paying their bills.

Moreover, the data also suggests that when presented with a convenient and automated method of bill paying, customers are going to opt to use it in significant numbers. Over time, this will more than justify the effort involved in adopting such a technology in the first place.

We’re Here to Help

Call 1 800 831 6660 or

What our clients are saying about us

“Never any issues with you guys! Things just work.”

“Customer service is a really big deal to us, and I am glad to do business with a company that obviously takes it as seriously as we do.”

“We’re happy with the IVR Payment system and it has been working well for us. Recently we also setup your newest SMS (text) receipts and found it to work great.”

“I want to command you and your team at Datatel on the job just completed for Tele-Response Center. The attention to detail and professionalism with which you approached the project was exemplary and greatly appreciated especially considering the several applications that needed to be implemented on short notice. Thanks again for your assistance getting this project off the ground so smoothly.”

“My team and I would like to commend Datatel on creating an IVR application that adds great value to our new Travel product. Your knowledge, input and expertise in IVR scripting, call flow management and overall IVR logistics made the development and implementation stages extremely easy to manage. Thank you for a well executed campaign that was launched on time and on budget.”

“Great team to work with. I look forward to utilizing some additional capabilities in the future.”

“We are very grateful for many years of mutually beneficial business relationship with Datatel and for impeccable customer service we have received during these years.”

“We, Standard Life, very much appreciated Datatel’s expertise, knowledge and support as we worked through the development and implementation stages. Our Clients appreciate the simplicity of the capability, while gathering very valuable feedback. Thanks for making this a very positive experience.”

“This was one of the best implementations I have been a part of. The communication was excellent and everything was responded to and dealt with swiftly. A real pleasure. We are looking forward to the impact this will have on our patient payments! Thank you!”